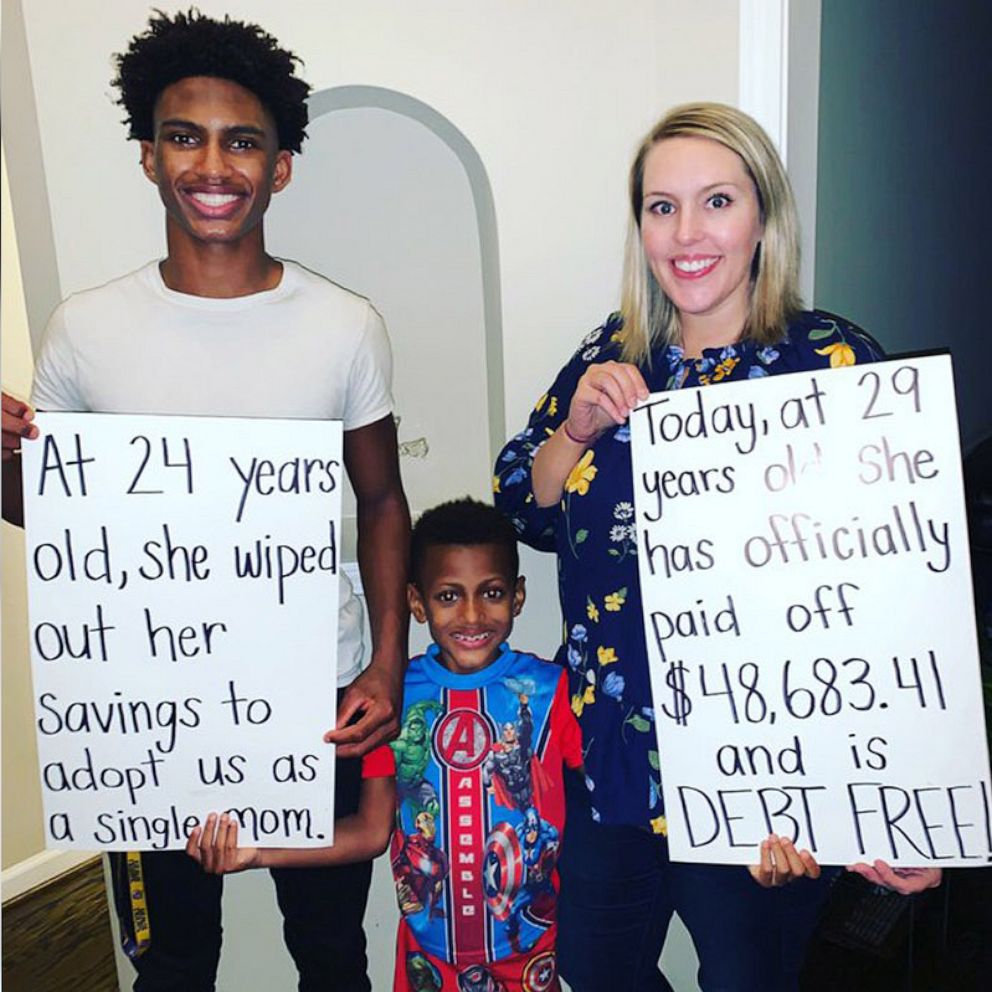

Teacher who adopted her former student and his brother eliminates over $48,000 in debt

A 29-year-old woman who adopted a former student and his brother is now celebrating being completely debt-free.

Chelsea Haley of Marietta, Georgia, has eliminated a total of $48,683.41 -- the amount she owed in credit cards and student loans with interest.

"It doesn't feel real yet," Haley, mom of Jerome, 17, and Jace, 6, told "Good Morning America." "It's so amazing. I even logged into my student loans and it said, 'Cleared. Zero balance.'"

Haley was teaching in Baton Rouge, Louisiana, in 2015, on a two-year commitment to Teach for America, which is an organization that recruits recent college graduates to work in low-income schools. Her son, Jerome, was in her 4th-grade class at the time.

When Haley saw Jerome getting suspended from school and failing to progress academically, she started spending time with him -- going to his football games, buying him school supplies and more, she told "GMA" in 2018.

Soon, Jerome asked Haley if he could live with her and in 2016, Haley gained full custody of the teen.

Chelsea now has full custody of Jerome's little brother, Jace, as well.

"Being their mom is the greatest blessing of my life," Haley said. "I get to wake up in the morning and love two little guys."

Haley said she wiped out her savings for attorney fees when seeking custody of the two boys. She also accumulated debt to afford taking care of them, which was piled onto deferred student loans.

Determine to rid herself of debt, Haley took on side jobs.

"On top of being a teacher, I was tutoring a couple of days a week," she said, adding that on Fridays, she was paid extra to stay late at the school and work as the building manager.

Haley also delivered groceries, sold her home and moved back in with her parents on Nov. 6.

Her current goal is to save money for a new house and prepare Jerome for college. Both boys are thriving in school, Haley said.

"It allows me to focus on the boys' future," she said. "Saving money for them, and not spending it on my past."

Her advice for tackling debt is never to ignore your spending and stick to a plan.

"Finances can be kind of scary and it's easier to be say, 'It's out of sight, out mind,'" Haley pointed out.

Here are more debt elimination tips from Haley...

1. List all your goals, starting with the high-interest bills you'd like to pay off.

2. Look through your paycheck and pay attention to what you're spending money on.

3. Consider additional sources for income, if your time allows.

4. Learn to say no to certain money-spending habits.

It's also key to stay motivated, Haley said, by "knowing you'll have a lot more freedom once it's paid off."

Editor's note: This was originally published on Dec.. 4, 2020.